#Copay vs deductible full#

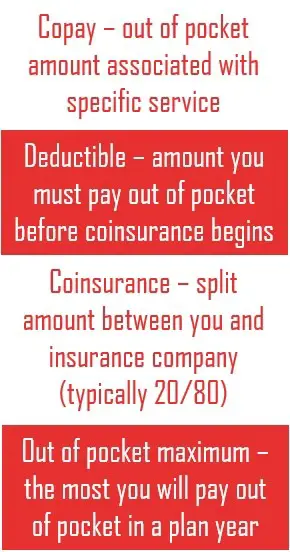

This means that you will need to pay the total fee of your healthcare expenses until you have reached your deductible, at which point your insurance company will begin to cover the remaining costs.įor example, if your insurance policy has a deductible of $1,000 and you still need to meet your deductible, you will need to pay the full cost of any healthcare services or treatments that you receive. ‘100% after deductible’ means that your insurance company will cover the total cost of a healthcare service or treatment once you have met your deductible. What does it mean by 100% after deductible Understanding the difference between these two terms is essential to manage the cost of your healthcare effectively. If your insurance policy requires that copays be counted toward your deductible, then the copays you pay for healthcare services will be applied toward your deductible. Once you have paid your deductible, your insurance company will begin to cover the remaining costs of your healthcare expenses. A deductible only applies once per policy period, typically one year.A copay applies every time you receive a covered healthcare service, such as a doctor’s visit or prescription medication.By requiring policyholders to pay a certain amount of their healthcare expenses out-of-pocket, insurance companies hope to incentivize policyholders to be more selective about their healthcare utilization and to consider the cost of care before seeking it. The purpose of a deductible is to help ensure that policyholders are invested in their own healthcare.It is usually a small fraction of the total cost of the service and is paid at the time of service. The purpose of a copay is to help cover the cost of healthcare services.What is the Difference Between a Copay and Deductible? Copay vs. For example, if your deductible is $1,000, you will need to pay the first $1,000 of your healthcare expenses before your insurance company will begin to cover the remaining costs. What is a Deductible?Ī deductible is a set amount you must pay out-of-pocket before your insurance company begins covering your healthcare expenses. For example, you may have a co-pay of $30 for a doctor’s visit, while the total cost of the visit may be several hundred dollars. This amount is typically paid at the time of service and is usually a tiny fraction of the service’s total cost. What is a Copay?Ī copay is a fixed amount you pay for a healthcare service, such as a doctor’s visit or prescription medication. Also, consider any limits on the number of copays or the deductible you may be required to pay.

Therefore, it’s important to carefully review the terms of your health insurance plan to understand your copays and deductibles.

Two terms that are commonly used in the context of medical insurance plan are “copay” and “deductible.” It is essential to understand the difference between these two terms, as they can significantly impact the cost of your healthcare.Īccording to a survey by the Kaiser Family Foundation, the average annual deductible for employer-sponsored health insurance in the United States in 2020 was $1,478. Health insurance can be confusing, with a range of terms and concepts that may not be familiar to everyone.

0 kommentar(er)

0 kommentar(er)